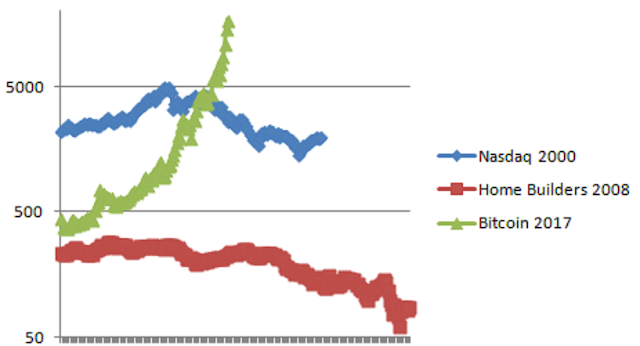

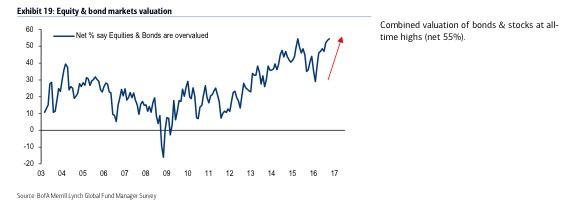

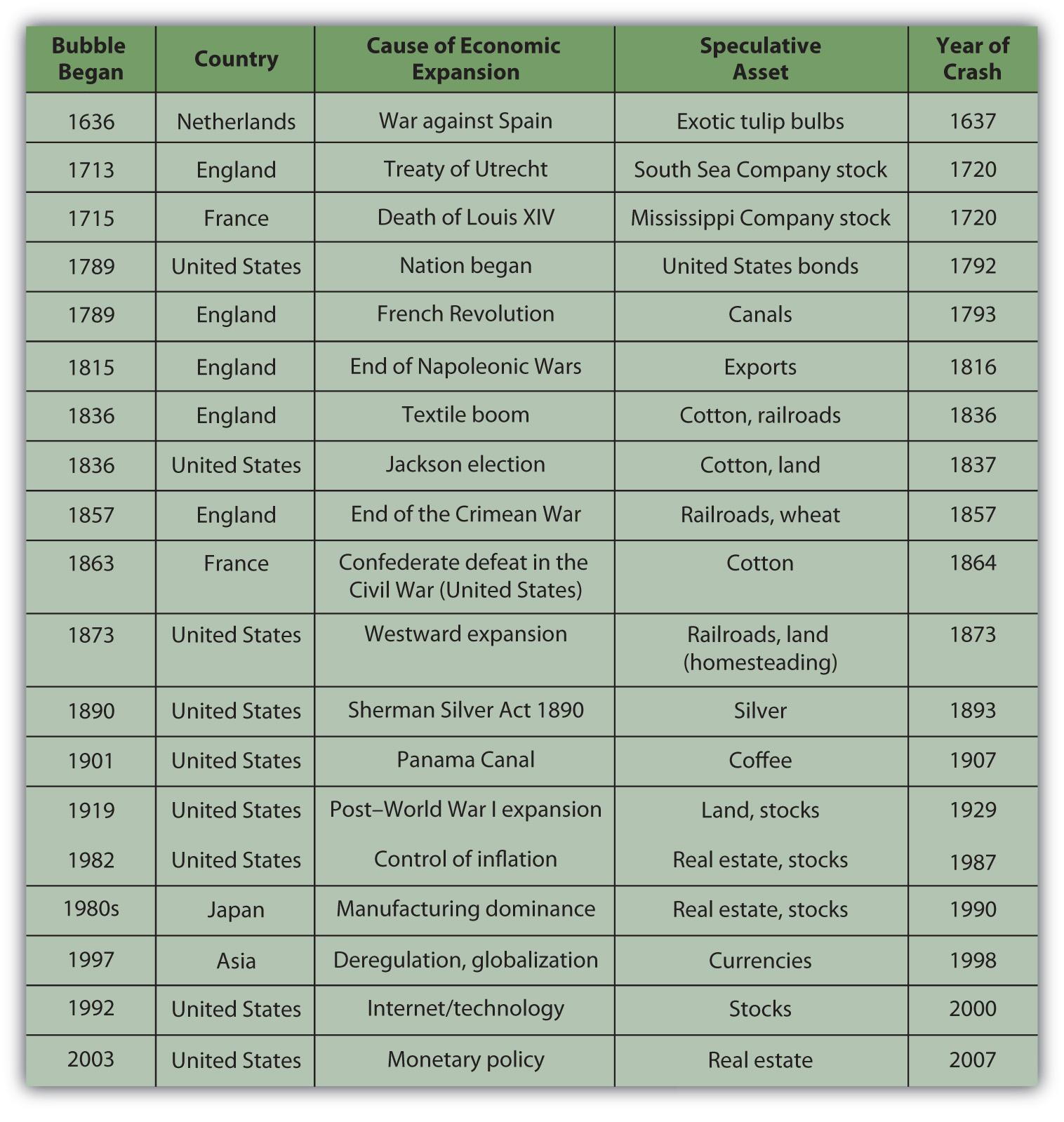

Most periods of excessive booms end with speculative busts. The dotcom bust of 2000 produced a recession so did the housing bust of 2008. Today's poster child seems to be bitcoin. Just as the internet was here to stay back in 2000 so is block chain technology today. However crypto currencies are trading at levels suggesting they could become reserve currencies of the world replacing the dollar and that implies a reset on short order. It's never different and always the same:

U.S. Birth Rate Drops To New Low After Pandemic ‘Baby Bump’

-

There were nearly 3.6 million births recorded in the U.S last year, a drop

of 2% from 2022.

16 minutes ago